Hyflux released their results yesterday and their Hyflux 6% CPS 10 perp price is again under pressure now as I am writing. Please read the report : https://www.theedgesingapore.com/hyflux-sinks-red-2q.

As you read the report, see the reasons given for their poor performance. Ask yourself if these reasons will affect their credit standing over the next 8 months?

Is this an opportunity? Yes, that is my opinion. Why?

- 3% coupon in Oct 17. Another 3% in Apr 2018. Total 6%

- Assuming I buy at 99.0, in Apr 2018, Hyflux is likely to return the money back to me at 100. That is another 1%.

- If money is not returned to me in Apr 2018, coupon will be reset to 8%. Hyflux is in my opinion likely to call back the bond as they do not need to resort to 8% borrowing cost.

- Hyflux has been paying good dividends, so they must pay the perp holders first before shareholders. In the event that they do not pay coupons, the coupons will be cumulative anyway, meaning that they must make good what they did not pay in the past on their next payments.

- Their main reason for poor performance is “continued weakness in Singapore power market”.

- Total of 7% gain in 8 months. If annualized, it will be higher. And this is before the use of margin.

Here is the daily chart. The last candle on the right is today’s candle which have not closed yet. Note the long wick a couple weeks ago on 21 July.

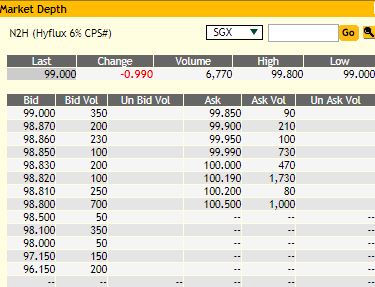

This is the market depth as of 12.07pm

SGX only allow queueing 0.20 away from last done. With last done at 99.00, I am queueing to try to get some between 98.80 to 99.00. Hyflux is considered Grade C bond, so its good to have some, but not too much. Ideal for buying using SRS account. Please read this article with a tiny pinch of salt as I am already holding some Hyflux perps.

You may be interested to know 2 other posts I made on Hyflux 6% perp recently.

- http://wealthlions.com/2017/07/hyflux-retail-bonds-sell-opportunity/

- http://wealthlions.com/2017/05/low-risk-6-to-8-return-in-11-months/

- I'm a remisier with Maybank Securities, and as a bonds and REITs investor myself, I guide my clients to build resilient bonds and REITs portfolios. If you like to be guided, please open a trading account to become my client; It's free!

- WealthLions is my blog where I journal my trading ideas and share my opinions about the markets. If you like to be kept posted of my new blog posts and events, please join my Telegram Channel and subscribe to my mailing list. No spam, I promise.