There used to be 44 REITS in Singapore. Now there are 37 after a number of mergers. Of these 37, personally, only 10 of them are worth investing.

Only 10? Hey, 10 is a lot. Try keeping up to date by digesting 10 reports quarterly for the rest of your life!

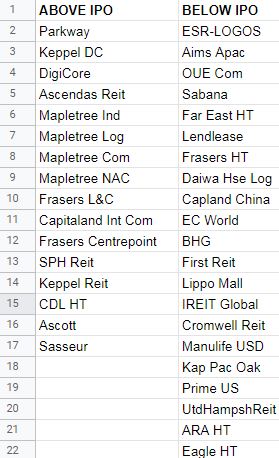

I have blogged many times about REITS with rising DPU is more likely to rise in price. By charting the DPU trend of every REIT and selecting the DPU charts that are rising, there are only 10 REITS worth investing in. But today, I shall explain a simple filter to remove 21 of the 37 REITS from your consideration.

Consider only REITS whose price today is above its IPO price.

Its amazing that 21 REITS today are below their IPO prices! So if one were to invest in every REIT IPO, the chances are that he will be losing money. So be really careful in the next REIT IPO.

So what are the 10 REITS worth investing for the long run? I think if we were to stick to these 10, we can sleep well at night.

- Parkway

- Keppel DC

- Ascendas Reit

- Mapletree Ind Tr

- Mapletree Log Tr

- Mapletree Com Tr

- Mapletree NAC

- Capitaland Int Com Tr

- Frasers L&C

- Frasers Centrepoint Tr

Good thing also is that the current rising rates has brought these REITS down to reasonable prices.

- I'm a remisier with Maybank Securities, and as a bonds and REITs investor myself, I guide my clients to build resilient bonds and REITs portfolios. If you like to be guided, please open a trading account to become my client; It's free!

- WealthLions is my blog where I journal my trading ideas and share my opinions about the markets. If you like to be kept posted of my new blog posts and events, please join my Telegram Channel and subscribe to my mailing list. No spam, I promise.