When evaluating my leveraged portfolio and SRETS, I like to compare their Interest Coverage.

INTEREST COVERAGE = EARNINGS / INTEREST EXPENSE

EARNINGS for my portfolio is the net profit deducting the finance cost from the coupon (or dividends received).

INTEREST EXPENSE for my portfolio is the interest I have to pay a year for my debt.

- >1 means pass

- >1.5 is normal

- >3 is very good

- >5 is excellent

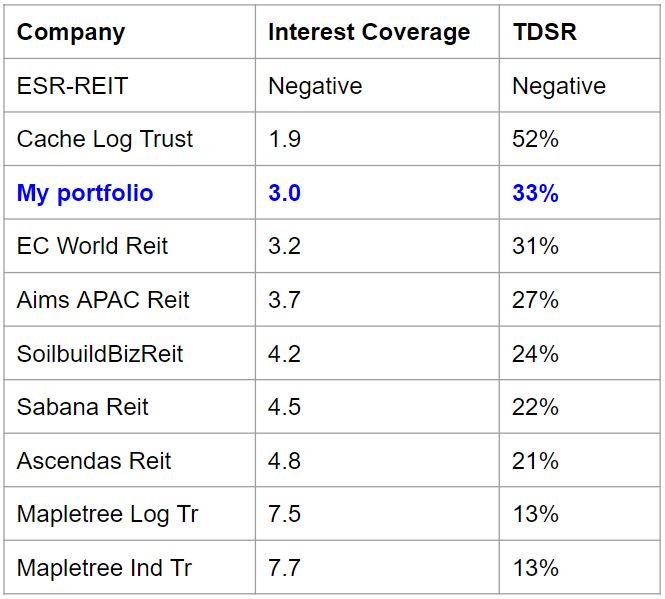

The INTEREST COVERAGE ratio for my investment portfolio is 3.0. I classify this as good.

While most stock investors are familiar with INTEREST COVERAGE, most Singaporeans are more familiar with TDSR or Total Debt Servicing Ratio. Our government limits the amount borrowers can spend on debt repayments of their properties to 60% if their gross monthly income. Means TDSR must < 60% when buying property.

How is INTEREST COVERAGE related to TDSR?

INTEREST COVERAGE = 1 / TDSR

The TDSR for my portfolio is 33%, which is in the safe zone.

Below are some INTEREST COVERAGE ratios and TDSR of some industrial Reits.

Most this table, its clear that the blue chip Reits prices are high for a good reason. They are very well managed when compared with the smaller Reits. Nowadays I do not invest in Cache Log Tr and SoilbuildBizReit anymore. Such Reits are only for shorter term tactical plays. For long term investments, I only invest in top quality Reits such as Mapletree Ind Tr or Mapletree Com Tr.

- I'm a remisier with Maybank Securities, and as a bonds and REITs investor myself, I guide my clients to build resilient bonds and REITs portfolios. If you like to be guided, please open a trading account to become my client; It's free!

- WealthLions is my blog where I journal my trading ideas and share my opinions about the markets. If you like to be kept posted of my new blog posts and events, please join my Telegram Channel and subscribe to my mailing list. No spam, I promise.