It was recently announced that Singapore REIT ETFs are no longer subjected to 17% corporate tax on their S-REITs distributions. This will apply from 1 July 2018 onwards. (http://www.businesstimes.com.sg/government-economy/singapore-budget-2018/singapore-budget-2018-tax-transparency-to-apply-for-s-reit)

There are 3 REIT ETFs listed in SGX:

- PHIL AP DIV REIT S$D (BYJ.SI)

- NikkoAM-STC Asia REIT (CFA.SI)

- LION-PHILLIP S-REIT (CLR.SI)

The LION-PHILLIP S-REIT etf stands to benefit the most as their universe are only S-REITS. The other 2 ETFs have Australian REITs that still have to pay 15% withholding tax of the DPU paid.

LION-PHILLIP S-REIT pays dividends 2x a year, and will have their first XD on 2nd Mar 2018. At the current price, their dividend yield is expected to be 4.6% after tax and management fee.

With the new change, will their future dividend yield be 4.6% x 1.17 = 5.38%? When will their DPU be boosted to reflect the new tax laws? I called Lion-Phillip today, but the staff could not answer me, but they did promised to get back to me.

Meanwhile, the stock price has not moved much since the government announcement.

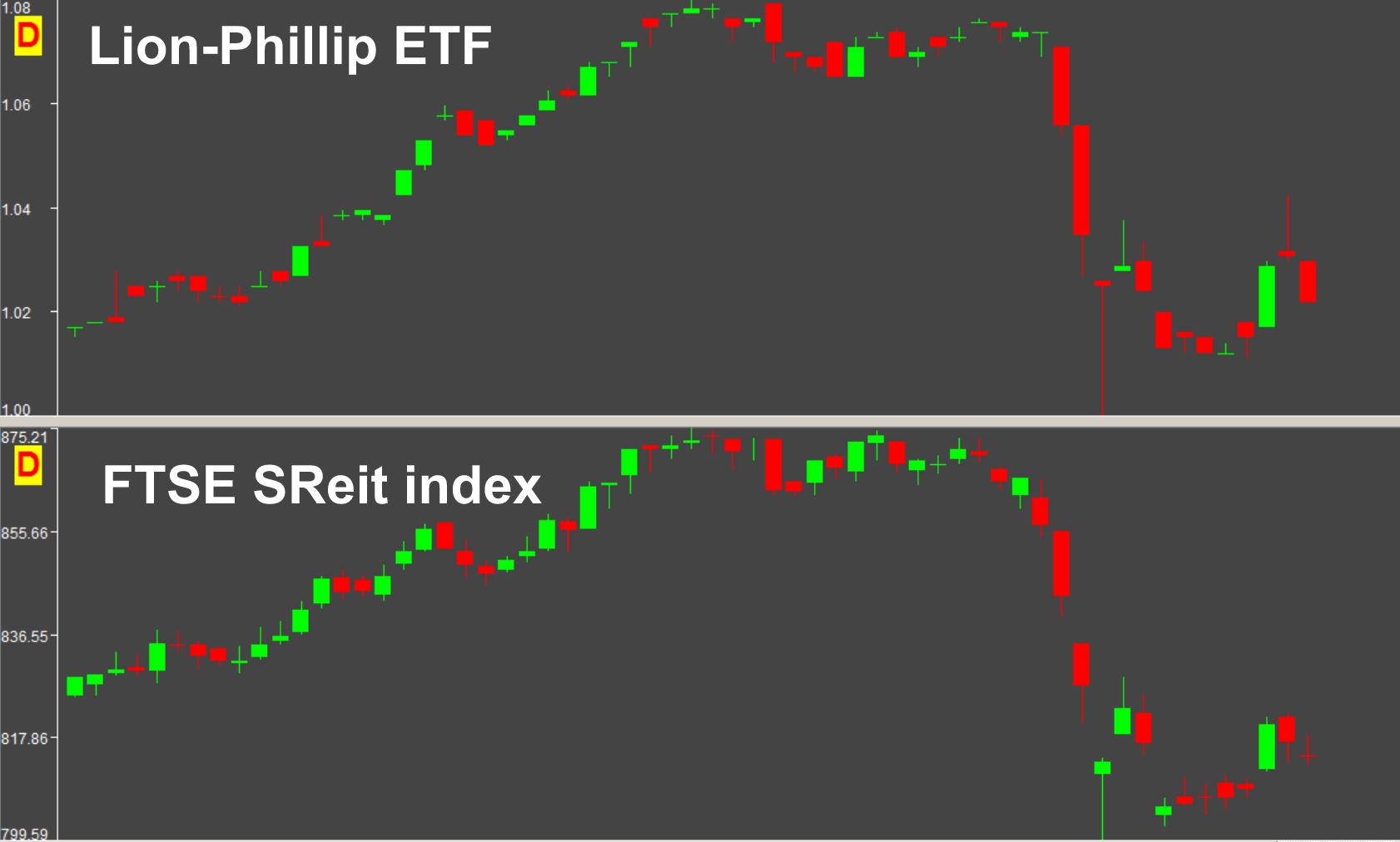

I have also checked if the price movement makes sense by comparing with the FTSE SREIT index.

The price movement looks sound. Price has corrected recently to $1.024, which is quite close to the IPO price of $1.0.

To know what the LION-PHILLIP S-REIT consist of, please read my past post: http://wealthlions.com/2017/10/analysis-phillip-lion-etf/

Before you invest, please understand what you are buying by reading the ETF details first: http://www.lionglobalinvestors.com/en/funds/lion-phillip-s-reit-etf/index.html#library?fcode=LEPF&fname=Lion-Phillip%20S-REIT%20ETF

Note that LION-PHILLIP S-REIT

- cannot be bought using CPF

- can be bought using SRS

- can be bought using Maybank Kim Eng margin account financing at 2.88% at 70% loan to value ratio.

Assuming that the dividend yield is at 5%, using $10,000 to buy $20,000 worth of LION-PHILLIP S-REIT, and financing $10,000 at 2.88%, the net supercharged return is about 7.1%.

If you’ll like to know more about using a stocks margin account to safely supercharge your yield, please contact me.

And by the way, even with the lack of clarity from Lion-Phillip, I plan to nibble a bit of LION-PHILLIP S-REIT using my margin account tomorrow, depending on how the market moves.

- I'm a remisier with Maybank Securities, and as a bonds and REITs investor myself, I guide my clients to build resilient bonds and REITs portfolios. If you like to be guided, please open a trading account to become my client; It's free!

- WealthLions is my blog where I journal my trading ideas and share my opinions about the markets. If you like to be kept posted of my new blog posts and events, please join my Telegram Channel and subscribe to my mailing list. No spam, I promise.