http://boringinvestor.blogspot.sg/2017/08/did-hyflux-make-money-for-its-ordinary.html

Month: August 2017

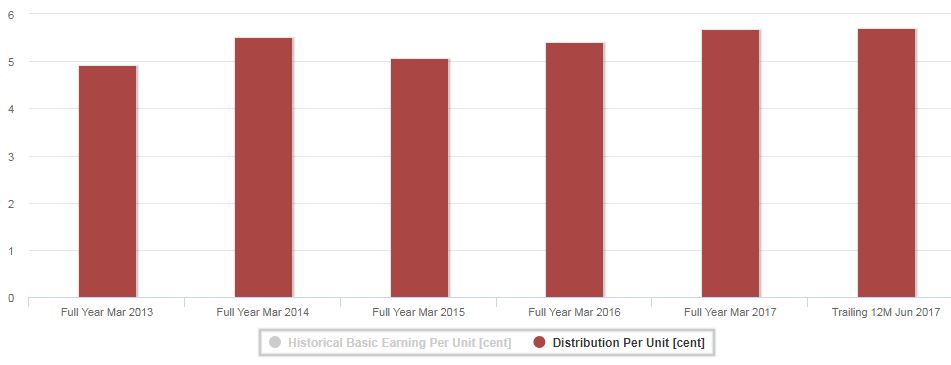

Ascendas HTrust entry

Last week, my REITs shifu invested in Ascendas HTrust, which I also followed yesterday, because I concurred with his assessment.

- Yield : 6.9%

- Gearing : 33%

- P/NAV : 0.93

- Run 11 hotels

- By NPI, Australia (50%) + Japan (26%) + Singapore (15%) + China (9%)

I like the fact that the DPU trend has been very stable through the years. I am also speculating that Australia will growing in next couple of years. For me, this is a long term investment and not a short term trade. My yield on cost is 6.87%.

My shifu, Kenny Loh (http://mystocksinvesting.com/), will be conducting his signature REITs course on 30 Sep. If you’ll like to learn how a REITs expert evaluates and selects strong REITs, I strongly encourage you to attend his course. Contact me for a discount code.

Hyflux bad news is good news for me

Hyflux released their results yesterday and their Hyflux 6% CPS 10 perp price is again under pressure now as I am writing. Please read the report : https://www.theedgesingapore.com/hyflux-sinks-red-2q.

As you read the report, see the reasons given for their poor performance. Ask yourself if these reasons will affect their credit standing over the next 8 months?

Is this an opportunity? Yes, that is my opinion. Why?

- 3% coupon in Oct 17. Another 3% in Apr 2018. Total 6%

- Assuming I buy at 99.0, in Apr 2018, Hyflux is likely to return the money back to me at 100. That is another 1%.

- If money is not returned to me in Apr 2018, coupon will be reset to 8%. Hyflux is in my opinion likely to call back the bond as they do not need to resort to 8% borrowing cost.

- Hyflux has been paying good dividends, so they must pay the perp holders first before shareholders. In the event that they do not pay coupons, the coupons will be cumulative anyway, meaning that they must make good what they did not pay in the past on their next payments.

- Their main reason for poor performance is “continued weakness in Singapore power market”.

- Total of 7% gain in 8 months. If annualized, it will be higher. And this is before the use of margin.

Here is the daily chart. The last candle on the right is today’s candle which have not closed yet. Note the long wick a couple weeks ago on 21 July.

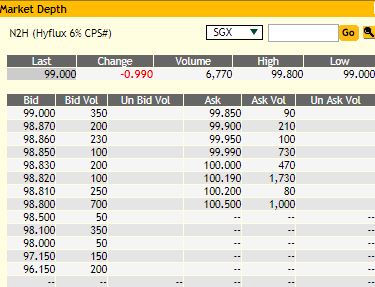

This is the market depth as of 12.07pm

SGX only allow queueing 0.20 away from last done. With last done at 99.00, I am queueing to try to get some between 98.80 to 99.00. Hyflux is considered Grade C bond, so its good to have some, but not too much. Ideal for buying using SRS account. Please read this article with a tiny pinch of salt as I am already holding some Hyflux perps.

You may be interested to know 2 other posts I made on Hyflux 6% perp recently.

Investing ideas for high yield bonds

Top grade bonds that can be supercharged using margin accounts are few. I was asked recently what are the junk bonds (high yield) bonds that have caught my eye. I have listed some bonds that looks interesting and have ordered them according to my preference. Admittedly, i have yet to dive deep into these companies as I do not plan to invest in them.

- Sabana 4% Mar 2018, price 99.0, YTM 5.5%

- Sabana 4.25% Apr 2019, price 96.0, YTM 6.8%

- Religare Heath Trust 4.5% July 2018, price 99.7, YTM 4.8%

- CWT 4.8% 2020, price 99.8, YTM 4.9%

- Ara 5.2% perp, price 103.5, YTC 4.4%

- Centurion 5.25% July 2018, price 100.7, YTM 4.4%

- Tuan Sing 4.5% Oct 2019, price 98.2, YTM 5.3%

- Tuan Sing 6% Jun 2020, price 100.5, YTM 5.8%

- Tat Hong 4.5% Jul 2018, price 99.0, YTM 5.6

- G8 Education May 2019, price 99.9, YTM 5.5%

- Oxley 6.375% 2021 USD, Price 100.4, YTM 6.2%

- Aspial 5.05% Jun 2019, price 100, YTM 5%

- Tiong Seng 4.75% Jan 2018, price 100, YTM 4.7%

- TA Corp 5.5% Mar 2018, price 97.5, YTM 9.4%

- Banyan Tree 5.75% Jul 2018. price 101.1, YTM 4.6%

- Banyan Tree 5.35% Nov 2018. price 100.4, YTM 5.0%

- Pacific Int Lines 7.25% Nov 2018, price 99.8, YTM 7.4%

Note that these bonds are not investment grade and hence cannot be margined at good rates. The prices used are from bondsupermart.com prices which is only a guide to the real prices and does not include any commission.