When it was clear to me at 8.54am this morning that OUE will not be calling back their OUE 4.25% 2019 on 30 Oct 2017, I bought my 2nd OUE bond today.

Please read previous post http://wealthlions.com/2017/09/bought-oue-4-25-30oct2019-101-40/, which describes the terms of this unique senior bond with multiple call dates with different redemption prices.

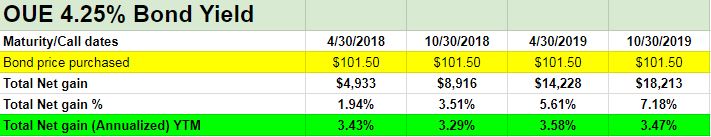

I have compile the YTCs and YTM of each maturity dates, based on the price of 101.5 with commissions included :

The average YTM is 3.44%.

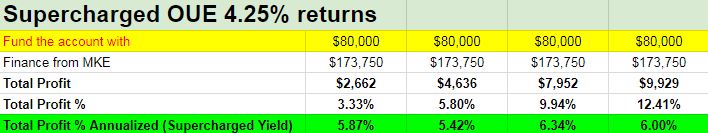

If I were to buy using margin account by funding $80k collateral, the following will be my returns:

The average supercharged yield is 5.9%.

If you want to know how I arrived at the above tables, you may find my spreadsheet here: https://docs.google.com/spreadsheets/d/1rRJAlfbeO0y-6-FLw1biP1FpvGCDVh0mTXt-3sZYhVU/edit?usp=sharing

What are my considerations for buying OUE 4.25% 2019?

- Which senior bond (duration <3 years) of Singapore blue chip financial or property company has a YTM of more than 3%? You are right that there is none – except for this OUE bond.

- The YTM of other short duration OUE bonds such as OUE 3.03% 2020, and OUE 3.8% 2020 are both < 3%.

- Investors probably do not know how to analyze bonds with multiple call dates. Contrary to traditional thinking, multiple calls dates is not a disadvantage for me. In fact, it is an advantage. Multiple call “ensure” that prices hover around their redemption prices.

- When supercharging, there is no need for prices to move up to make money. As long as the prices stay about the same, I can make the difference between the lending rate and borrowing rate.

- Prices being stable around their redemption prices is a strong protection even if interest rates were to rise.

- OUE is backed by the Lippo Group, one of the largest real estate developers with US$15B in assets. What is the probability that it becomes bankrupt in 2 years?

In summary, OUE bond gives reasonable returns with very minimum risks, a good risk vs reward investment – and better than any 2Y fixed deposits.

If you are new to bonds and want to learn more, do consider coming for my next supercharged bonds seminar. Sign up at http://sb1.eventbrite.sg

- I'm a remisier with Maybank Securities, and as a bonds and REITs investor myself, I guide my clients to build resilient bonds and REITs portfolios. If you like to be guided, please open a trading account to become my client; It's free!

- WealthLions is my blog where I journal my trading ideas and share my opinions about the markets. If you like to be kept posted of my new blog posts and events, please join my Telegram Channel and subscribe to my mailing list. No spam, I promise.