I bought OUE 4.25% 30 Oct 2019 bond a couple days ago.

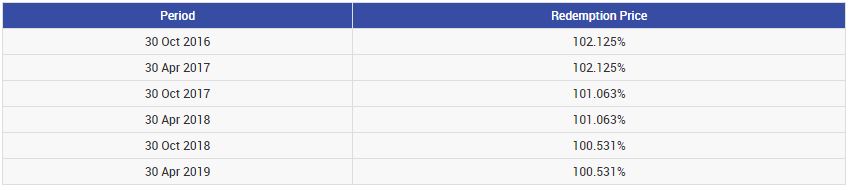

This is one of the more complicated bond that is difficult to explain. It is a bond with 1 fixed maturity but with multiple call dates at different redemption prices. Because of the multiple call dates, there are different YTC (yield to call) numbers.

- Issuer : OUE (Overseas Union Enterprise)

- Coupon : 4.25%

- Price purchased : 101.4

- Fixed Maturity on 30 Oct 2017 (2.1 years ) with multiple call dates

- Ranking : Senior

- Issue Size is S$200M

This is the redemption prices for the difference call dates :

I have built a spreadsheet to calculate the exact returns to the near cent for each of the call dates, including returns using margin. Some of the key numbers are:

- Call date on Apr 2017 and Oct 2017 has passed without being called back

- YTC on Oct 2017 : 1.03% (this is the yield to worst)

- YTC on Apr 2018 : 3.64%

- YTC on Oct 2018 : 3.41%

- YTC on Apr 2019 : 3.66%

- YTM on Oct 2019 : 3.53%

- If supercharge using margin account, the net yield is about 6%.

The big question is whether OUE call back this bond end of Oct 2017? One way is to study their annual report find out if they are sitting on a pile waiting to return to bondholders, and then make an informed decision whether to invest. For me, I just go with a little common sense. You see, OUE issued S$200M of OUE 3.75% bond on 17 Apr 2017 this year. They had their chance to call back the 4.25% on 30 Apr 2017, but did not.

There are little nuances to this bond such as :

- As the date approaches the various call dates, the market price will move towards the redemption prices.

- If OUE so decides to call back this bond, they will need to give notice not less than 30 days before each call date.

Is 6% a bit low? Depends on what you are comparing with. If I compare with 2Y fixed deposits, the OUE bond is a lot more attractive. There is no investment grade property senior bond giving returns higher than 3%. And 2 years duration is very attractive. The only gamble is whether they will call back next month.

If you are interested in the spreadsheet to know the exact returns that you will get from buying this bond today, you may contact me.

- I'm a remisier with Maybank Securities, and as a bonds and REITs investor myself, I guide my clients to build resilient bonds and REITs portfolios. If you like to be guided, please open a trading account to become my client; It's free!

- WealthLions is my blog where I journal my trading ideas and share my opinions about the markets. If you like to be kept posted of my new blog posts and events, please join my Telegram Channel and subscribe to my mailing list. No spam, I promise.