One of my most common confusion among investors is to think that The Centrepoint at Orchard Road is owned by Frasers Centrepoint Trust (J69U.SI). It is not. The Centrepoint is owned by Frasers Property. What are the shopping malls owned by Frasers Centrepoint Trust (FCT)?

FCT now owns

- Yishun Northpoint

- Woodlands Causeway Point

- YewTee Point

- Queenstown Anchorpoint

- Punggol Waterway Point

- Changi City Point

It will soon also own

- Tiong Bahru Plaza

- Hougang Mall

- Pasir Ris White Sands

- Tampines Century Square

- Tampines 1

Why do I like FCT?

- Except for Anchorpoint which is 10 min walk from MRT, are all other 10 malls are next to the MRT?

- Except for Changi City Point, are all other 10 malls are surrounded by HDB flats?

- Which Reit sector is poised to recover first when the world returns to normal?

- Suburban malls are more defensive than malls in the city, as there is higher proportion of F&B and essential services. Does FCT’s malls depend on tourist traffic?

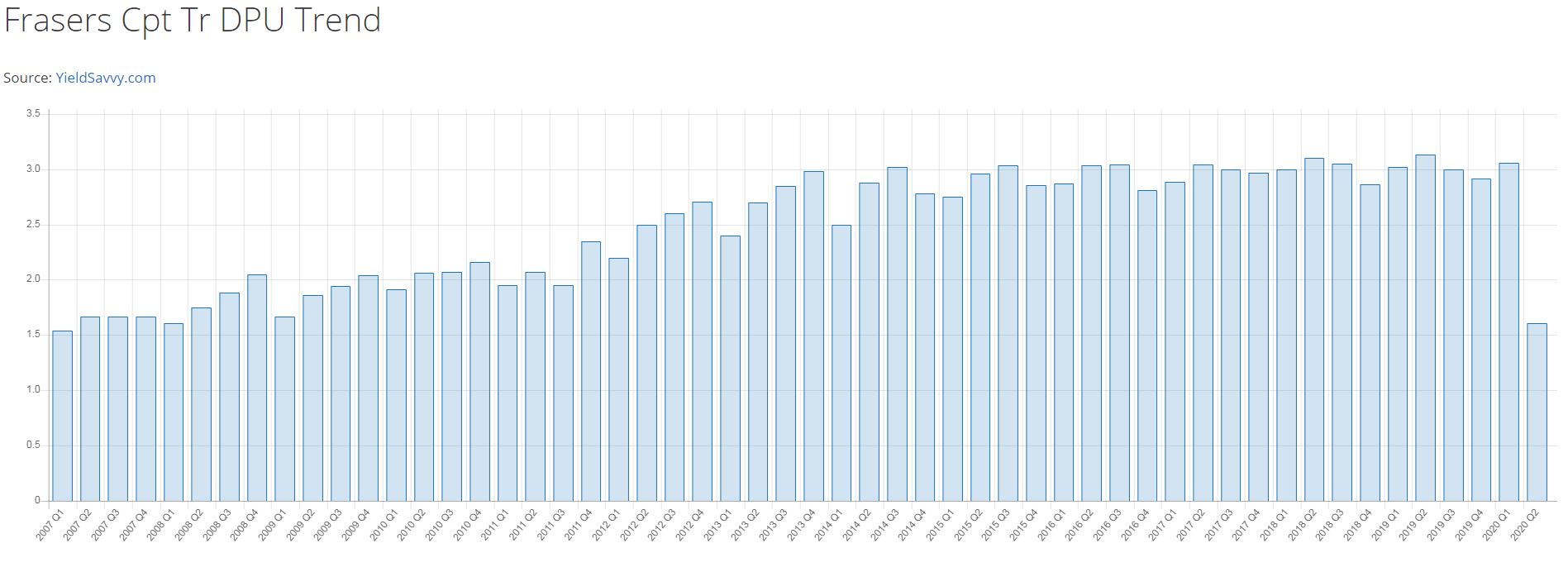

- FCT management has delivered growing Dividend per Unit (DPU) through the years, till Covid19 struck. Will FCT’s DPU return to pre-covid levels?

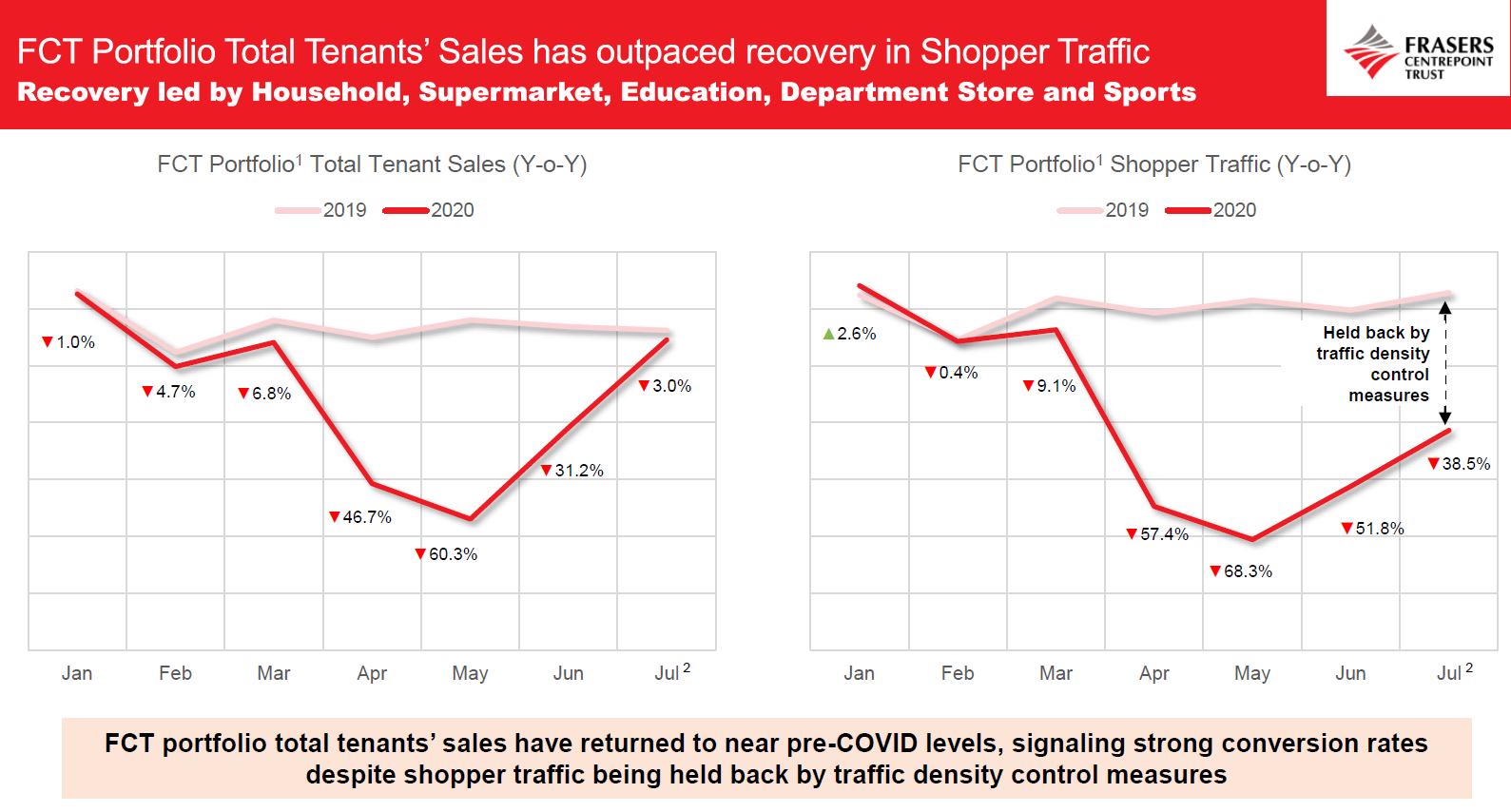

- FCT’s tenant sales is already back to near pre-covid levels, despite traffic density control measures. What will happen when shopper traffic returns to normal?

On 28 Sep, FCT raised $575M via a private placement at the issue price of $2.35. It was 2.8x subscribed. The share price promptly dropped to 2.37.

There will be a preferential offering conducted soon. Allotment ratio is not announced yet. Eligible unitholders will be provisionally allotted the preferential offering units based on their holdings in FCT as at 5pm 6 Oct. Although FCT announced the issue price range will be between $2.34 and $2.42, I am expecting the issue price to be at $2.34.

Below are some answers that I think some investors will be asking:

- $2.35 area is the support

- From now till 7 Oct, the price is likely to hoover around this area of $2.35 to $2.42

- From the recent past equity fund raising of Reits where the issue price was not severely discounted, the share price tends to go up after the corporate action

- The main risk I see is the general market sentiment. Market is expected to be volatile. If the whole market drops, FCT will drop as well.

- The issue price and market price is so close that it does not really matter if you buy FCT from the market or from preferential offering.

- I have been an investor of FCT for many years, have added and will continue to add.

Reference links:

- I'm a remisier with Maybank Securities, and as a bonds and REITs investor myself, I guide my clients to build resilient bonds and REITs portfolios. If you like to be guided, please open a trading account to become my client; It's free!

- WealthLions is my blog where I journal my trading ideas and share my opinions about the markets. If you like to be kept posted of my new blog posts and events, please join my Telegram Channel and subscribe to my mailing list. No spam, I promise.