I always compare my leveraged returns against the best practices in the market, such as professional REIT managers borrow banks to make money for their Real Estate Investment Trusts (REIT). This allows me to evaluate the risks that I am taking vs the potential returns.

I like to use DEBT to EARNINGS ratio.

DEBT is the total debt amount.

EARNINGS for my portfolio is the net profit deducting the finance cost from the coupon (or dividends received).

- <8 is very good

- >20 means not worth looking at

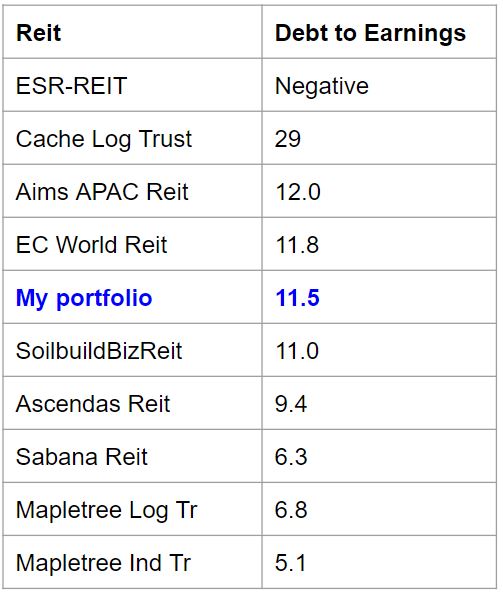

The DEBT to EARNINGS ratio for my investment portfolio is 11.5.

This means my earnings can pay off my debts in 11.5 years. How does this compare with best practices? Below are some Debt to Earning ratios of some industrial Reits.

Surprised? The Debt to Earnings of my portfolio is even better than some famous SREITS! This gives me some assurance that my leverage portfolio is on track.

I have been using this ratio for some years, and have observed that the blue chip Reits typical have much lower Debt to Earnings ratio. My portfolio have never beaten the Mapletree and Capitaland Reits on this ratio.

Well, if you cannot beat them, join them! When I first started investing many years ago, I tend to invest in Reits with higher yield such Lippo Malls and Aims Apac Reit. Nowadays I do not invest in this anymore. Such Reits are only for shorter term tactical plays. For long term investments, I only invest in top quality Reits such as Mapletree Ind Tr or Mapletree Com Tr.

(Note to readers is that investment portfolio size is really miniscule! They are a galaxy away from typical SREIT portfolio size.)

- I'm a remisier with Maybank Securities, and as a bonds and REITs investor myself, I guide my clients to build resilient bonds and REITs portfolios. If you like to be guided, please open a trading account to become my client; It's free!

- WealthLions is my blog where I journal my trading ideas and share my opinions about the markets. If you like to be kept posted of my new blog posts and events, please join my Telegram Channel and subscribe to my mailing list. No spam, I promise.