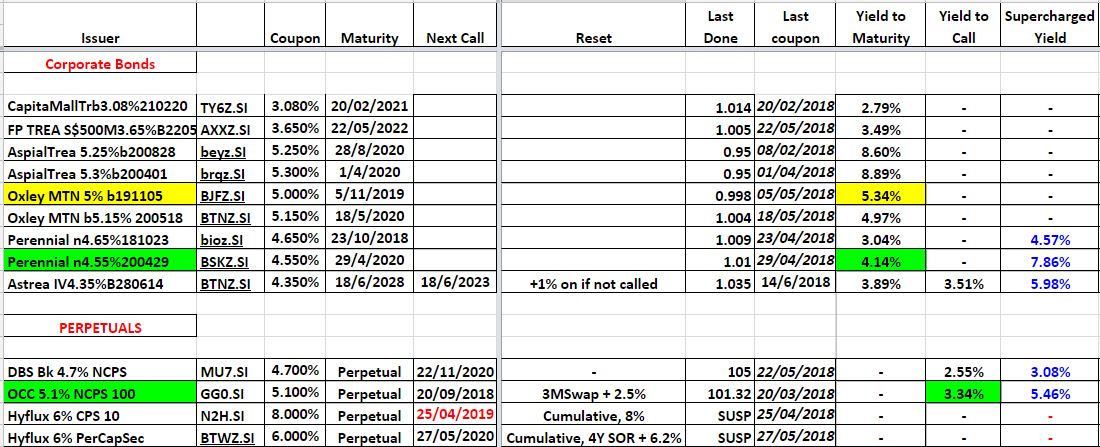

Astrea IV4.35%B280614 (BTNZ.SI) made its debut in SGX. At time of writing, the last done was 1.035. YTC of 3.34% for 5 years is fair value to me. Rise of interest rates may push down the price in near future.

Which retail bond stands out :

- OCC 5.1% NCPS (GG0.SI) looks good with a decent 3.3% YTC. Call date is a short 3 month away on 20 Sep 2018.

- Perennial n4.55%200429 (BSKZ.SI) YTM is > 4%. Matures in about 1 year 10 months.

- Oxley MTN 5% b191105’s (BJFZ.SI) YTM of 5.34% is preferred to Oxley MTN 5.15% 200518’s (BTNZ.SI) YTM of 4.96%. It has shorter tenor, and yet higher yield. Note that Oxley is considered high yield bond. Their debt to equity at 2.6 is quite high.

All 3 counters can be purchased in SRS accounts. Astrea IV cannot be purchased using SRS.

Note also that I already holding all 4 counters mentioned in this blog. I currently holding all the bonds in the above table except Hyflux and Aspial.

- I'm a remisier with Maybank Securities, and as a bonds and REITs investor myself, I guide my clients to build resilient bonds and REITs portfolios. If you like to be guided, please open a trading account to become my client; It's free!

- WealthLions is my blog where I journal my trading ideas and share my opinions about the markets. If you like to be kept posted of my new blog posts and events, please join my Telegram Channel and subscribe to my mailing list. No spam, I promise.