http://infopub.sgx.com/FileOpen/Hyflux%20FY2017%20News%20Release.ashx?App=Announcement&FileID=490365

Summary

- Redemption of Hyflux 6% CPS (N2H.SI) deferred until Tuaspring divestment. The process of selling Tuaspring has taken longer than initially expected, Hyflux is committed to the partial divestment of Tuaspring at an acceptable price

- Coupon yield for the Hyflux 6% will be stepped up from 6% to 8% after 24 Apr 2018

- Hyflux cash balance of S$314 million, excluding another S$77 million held for sale

- HYFLUX posted net loss of S$116.4M in FY2017, loss driven by weak Singapore electricity market

- The oversupply of gas in the Singapore market has resulted in depressed electricity prices

sold by power generation companies to the national grid. This continued weakness in the

Singapore power market is expected to pose challenges for the Hyflux’s performance in

2018. Unless the Singapore power market shows improvement, Hyflux expects to

continue recording losses in 2018

Sell on rumour, buy on news? No, not for me. Only when any of the following is triggered will I consider to buy:

- Price at $50 or lower

- Hyflux makes insider trades of buying up Hyflux 6% CPS at market price

- More clarity on when Tuaspring can be divested

- Hyflux becomes postive or electricity prices increase substantially.

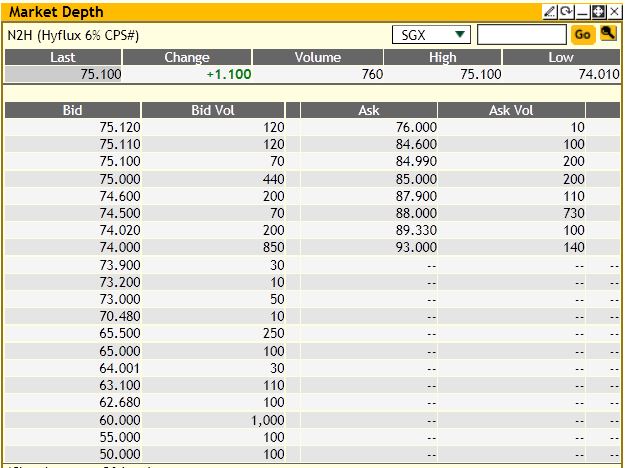

Here is the current market depth at 9.08am. Looks like there are more buyers than sellers at the current moment.

- I'm a remisier with Maybank Securities, and as a bonds and REITs investor myself, I guide my clients to build resilient bonds and REITs portfolios. If you like to be guided, please open a trading account to become my client; It's free!

- WealthLions is my blog where I journal my trading ideas and share my opinions about the markets. If you like to be kept posted of my new blog posts and events, please join my Telegram Channel and subscribe to my mailing list. No spam, I promise.