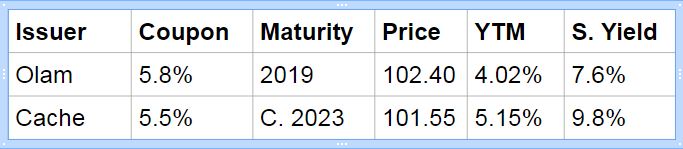

Corporate bond prices have softened recently. This couple of bonds looks interesting to me:

Why Olam?

- The maturity is July 2019. Olam announced strong earnings report for 2017 that caused many people to think commodities may be turning around. Is it likely they will bankrupt by July 2019?

- Temasek owns about 56% of Olam. What if Temasek announce they want to sell Olam? This bad news will cause the price to drop, but as long as you hold till maturity for the next 1.5 years, you will get your money back.

At 4% YTM, Olam 5.8% gives decent return considering their strong lineage.

Why Cache?

- Cache do not have strong lineage to a strong sponsor. CWT and ARA both have each about 4% of the company. But what Cache has are their property assets, which are valued at S$1207M. I like assets that looks good, and I can feel and touch.

- With a debt of S$446M, their gearing of 37% is relatively low.

- Although it is a perpetual, Cache perp has a reset on 1 Feb 2023. If Cache do not redeem this bond on that date, the coupon will be reset to the prevailing 5Y SOR + 3.58%. For example, the current SOR is now 2.13%. In 2023, if the 5y SOR is 3%, the coupon will be reset to 3 + 3.58% = 6.58%. This is the protection an investor gets in case the interest rises in the coming 5 years.

At 5.15% YTM, Cache 5.5% gives decent return considering their strong property assets.

- I'm a remisier with Maybank Securities, and as a bonds and REITs investor myself, I guide my clients to build resilient bonds and REITs portfolios. If you like to be guided, please open a trading account to become my client; It's free!

- WealthLions is my blog where I journal my trading ideas and share my opinions about the markets. If you like to be kept posted of my new blog posts and events, please join my Telegram Channel and subscribe to my mailing list. No spam, I promise.