One of my readers messaged me to ask why I am willing to accept returns of 6% annualized for OUE 4.25% 2019 bond. He asked:

“Are these the best options in the market? Thought you will be aiming for no less than 10%-12%? What is your plan for these OUE bonds?“.

Great question!

Currently in today’s market where most blue chip stocks, reits, and investment grade bonds has risen to high levels, which depresses their yield. 3 years, ago, we could easily buy many reits with yield above 7.5%, and many investment grade bonds that gives yield above 5%. However, to buy any counter at today’s prices, we have to be very selective, and ready to taken action quickly when opportunity arises.

For bonds which gives good passive income, my plan is to wait for new investment grade issues that gives > 5% YTM or YTC. This can give a supercharge yield of above 10% with leverage.

In the meantime, what to do with my spare cash? I plan to use OUE 4.25% 2019 bond as my proxy for cash. This unique bond has a call date every 6 months that scares people from buying, but to me is a great protection. Because of the call dates, I foresee that this OUE bond price will hover around the redemption price over the next 2 years. Read this post for the terms of this OUE bond. http://wealthlions.com/2017/09/bought-oue-4-25-30oct2019-101-40/

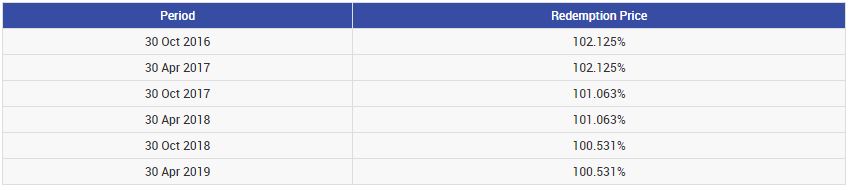

I shall post the call dates and redemption prices here again:

If the market tanks and with blood on the street, I am confidant to be able to sell this bond at reasonable prices and use the money to accumulate some stocks at great prices.

In summary, I would rather compare this bond investment with Fixed Deposits. Instead of looking at returns, I am looking at risk management.

- I'm a remisier with Maybank Securities, and as a bonds and REITs investor myself, I guide my clients to build resilient bonds and REITs portfolios. If you like to be guided, please open a trading account to become my client; It's free!

- WealthLions is my blog where I journal my trading ideas and share my opinions about the markets. If you like to be kept posted of my new blog posts and events, please join my Telegram Channel and subscribe to my mailing list. No spam, I promise.